Creating an invoice is a crucial part of running a business in the United States where it serves as an important document for both the seller and the buyer.

An invoice acts as a record of sale and is critical for bookkeeping and tax purposes — and of course as a payment request.

Here's a comprehensive guide on how to create an invoice in the U.S.

Choose the Right Method for You

You can create an invoice using various methods:

- Invoice Software: Invoicing software, like Simpler Invoice , helps you automate much of the invoicing process. You can create, send and track invoices easily, saving you time and effort.

- Templates: Microsoft Office, Google Docs, and other office suites offer invoice templates that you can customize.

- Custom Design: If you prefer, you can design your own invoice using graphic design software. This is sometimes chosen for branding purposes.

Add Invoice Details

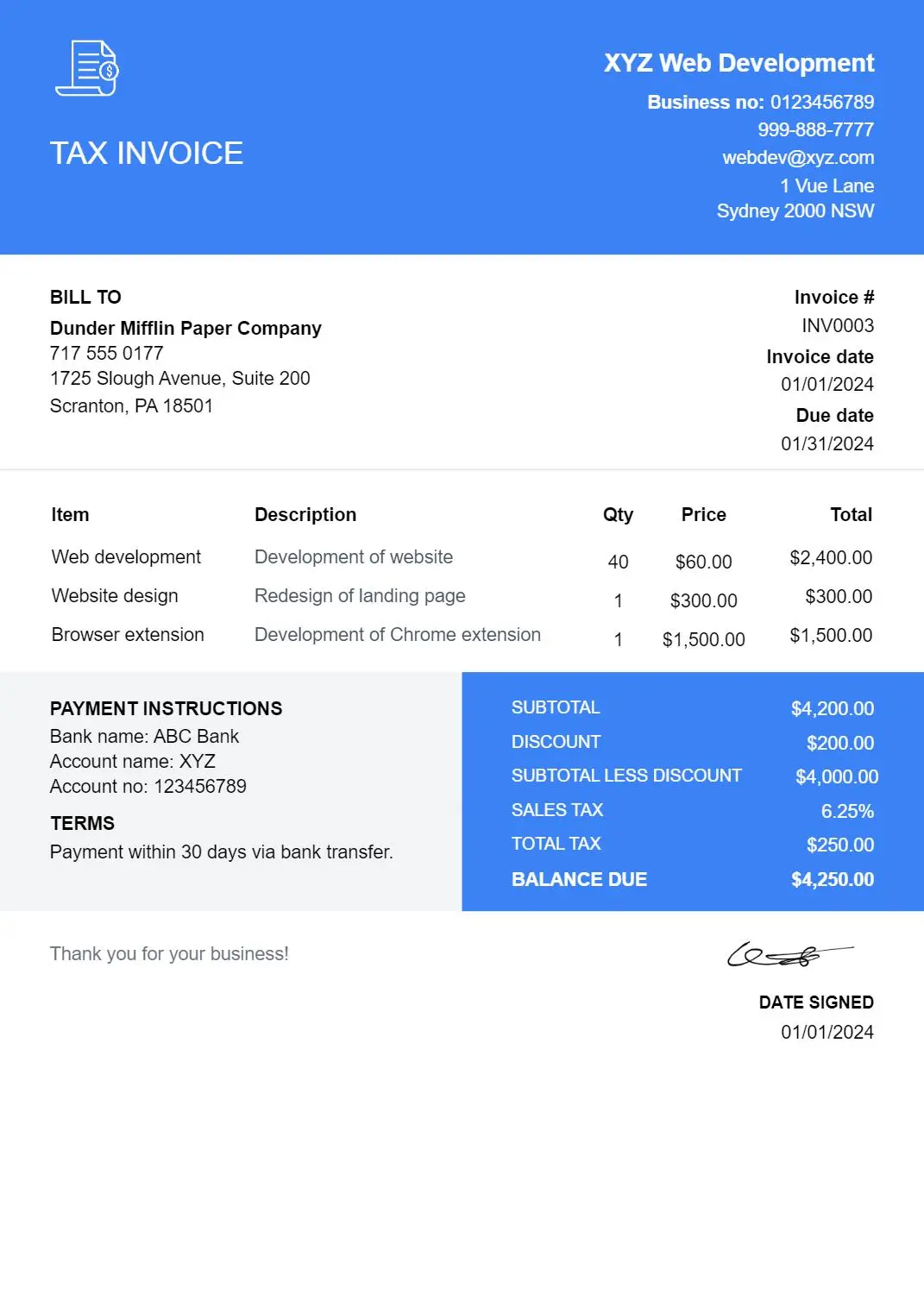

An invoice should include:

- Your Business Information: Your business name and contact details, such as an address, phone number, and email address. You can also include your logo and a signature.

- Client's Details: Name and address of the client or company you are billing.

- Invoice Number: A unique identifier for each invoice.

- Date: The issuance date of the invoice.

- Payment Terms: Due date, accepted payment methods, payment instructions and any late payment penalties.

- Description of Goods/Services: Detailed list of products/services provided with prices.

- Total Amount Due: Clearly state the total amount that is owed. If there are other amounts that affect the amount owed, such as a discount, make sure they are displayed as well.

- Taxes: If applicable, include tax calculations.

- Additional Notes: Any other relevant information, like thank-you notes or return policy.

We go more in-depth on what information is needed on invoices and why here:

How to Create an Invoice: A Step-by-Step Guide.

Ensure Legal Compliance

In the U.S., it's important to make sure your invoice adheres to legal standards.

If you are required to collect sales tax, ensure it's correctly calculated and displayed. If you want to do your own research, you can refer to this article on whether you should collect sales tax:

Depending on your industry, there might be specific legal requirements for invoicing.

Send the Invoice

Once your invoice is ready, it's time to send it to your customer.

It's important to send your invoice promptly after the sale or completion of services to avoid cash flow problems to your business.

Now, there are a few ways you can send an invoice:

- Use invoicing software to send it for you.

- Send a digital copy via email.

- Send a physical invoice through the mail

Make also sure to keep track of your invoices and follow up on late payments.

Keep Records

Keep a copy of all invoices for your records. This is important for accounting and taxation purposes.

It's highly recommended to organize your invoices well. A digital system that has a search function is ideal.

Tips for Effective Invoicing

Lastly, here are some tips to help you avoid common mistakes:

- Always double-check for errors before sending an invoice.

- Use a clean, professional design branded with your logo.

- Be clear and avoid ambiguity in your descriptions and terms.

- Discuss your payment terms with your client beforehand.

- Give a unique number to all of your invoices.

- Offering online payment options can speed up the process.

Additional Resources

Happy invoicing!