Creating an invoice is a critical task for any business or freelancer in Australia.

An invoice is not just a request for payment; it's also an important document for record-keeping and tax purposes.

In this guide, we'll walk you through the process of creating a professional invoice that helps you get paid as well as run a successful business.

Know the Mandatory Requirements

According to the Australian Taxation Office (ATO) , an invoice must include certain details:

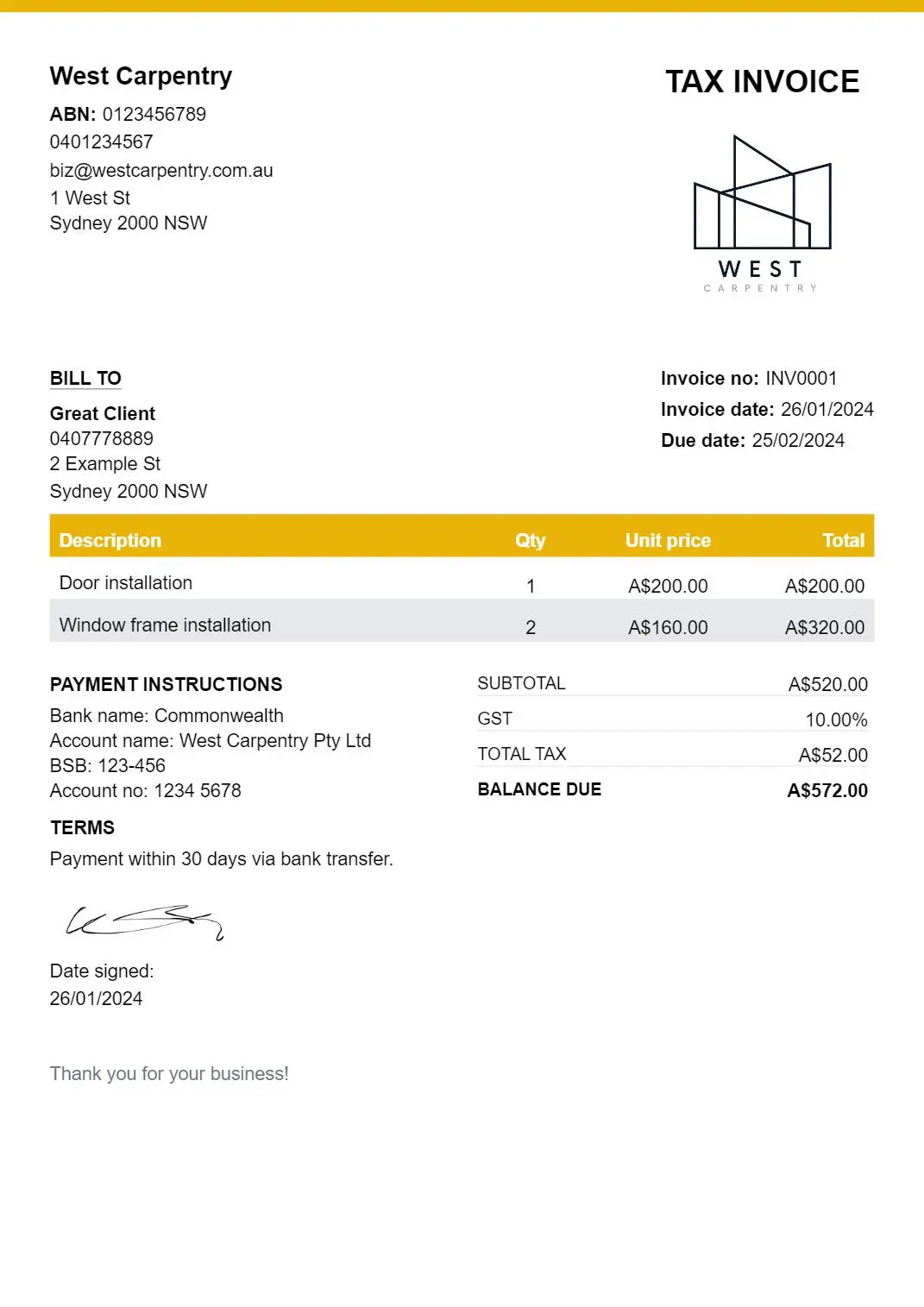

- The term "Tax Invoice" if you are registered for GST; "Invoice" if not.

- Your identity as the supplier, such as your business name or trading name.

- Your Australian Business Number (ABN).

- If the invoice is for sales of $1,000 or more, you also need to show the buyer's identity or ABN.

- The date the invoice was issued.

- A description of the items sold, including the quantity and price.

- The GST amount (if any) must be shown separately.

- The total amount payable.

You only need to charge GST if you're registered for it, which you must do if your business has an expected annual turnover of $75,000 or more.

Creating an Invoice

Now, let's go over all the steps involved in creating an invoice.

Choose How You Create the Invoice

You can create invoices manually with tools like Google Docs or Excel or use accounting software.

Accounting software, like Simpler Invoice , can be helpful as it can automate and speed up many parts of the process.

Add Your Details

First, add your business name or trading name and an Australian Business Number.

It's always good to include your contact details as well, such as an address and phone number. This helps your client to contact you should they have any questions.

Include Client Details

It's mandatory to add your client's identity if the invoice is for sales of $1,000 or more.

But as with your contact details, it's good practice to always include your client's details too. Add their name, contact information and an ABN if they have one.

Assign an Invoice Number

Each invoice must have a unique identifier like an invoice number.

This helps in tracking payments and organizing records, for both you and your customer.

List the Products or Services

Detail what you're charging for. Include each item's description, the number of hours or quantity, the rate, and the total cost.

If it's a tax invoice for sales of $1,000 or more, the GST amount for each item should also be displayed.

Calculate the Total

Add up the costs of the products or services provided. If you are registered for GST, make sure to calculate it correctly and add it to the subtotal.

If your sale comes with a discount or other amounts that affect the price, add them too.

Payment Instructions and Terms

Provide instruction for the payment here. For example, if your accepted payment method is bank transfer, add your bank details.

Clearly state your payment terms, including the due date. Also, include any late payment fees or discounts for early payment if applicable.

Notes

This final section is for any additional communication with your client. It could include a thank-you note, reminder, or specific instructions related to the invoice or services.

Tips

Here are a few tips to help you avoid common mistakes:

- Always double-check for errors before sending an invoice.

- Make sure each invoice has a unique number.

- Keep a copy of all invoices for your records. The ATO requires you to keep records for at least five years.

- Regularly follow up on unpaid invoices.

Resources

Australian government has many helpful resources to help business owners handle their operations and adhere to taxation laws. It's helpful to check them out if you haven't already.

Happy invoicing!